Banks and financial companies operate in a strictly regulated and increasingly competitive market, which requires carefully balancing the need to deliver high-quality services to their end-users with the need to improve on their cost-efficiency.

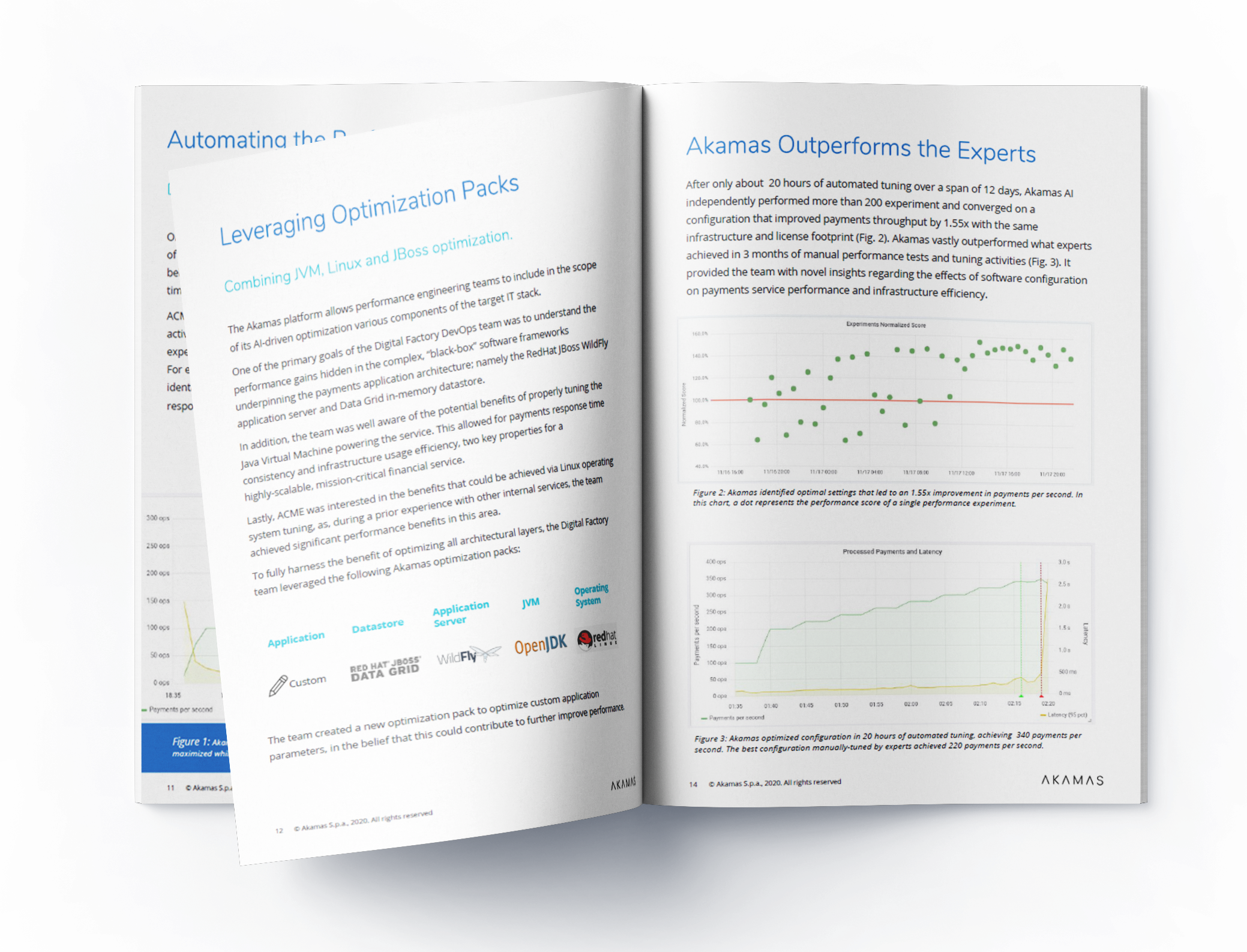

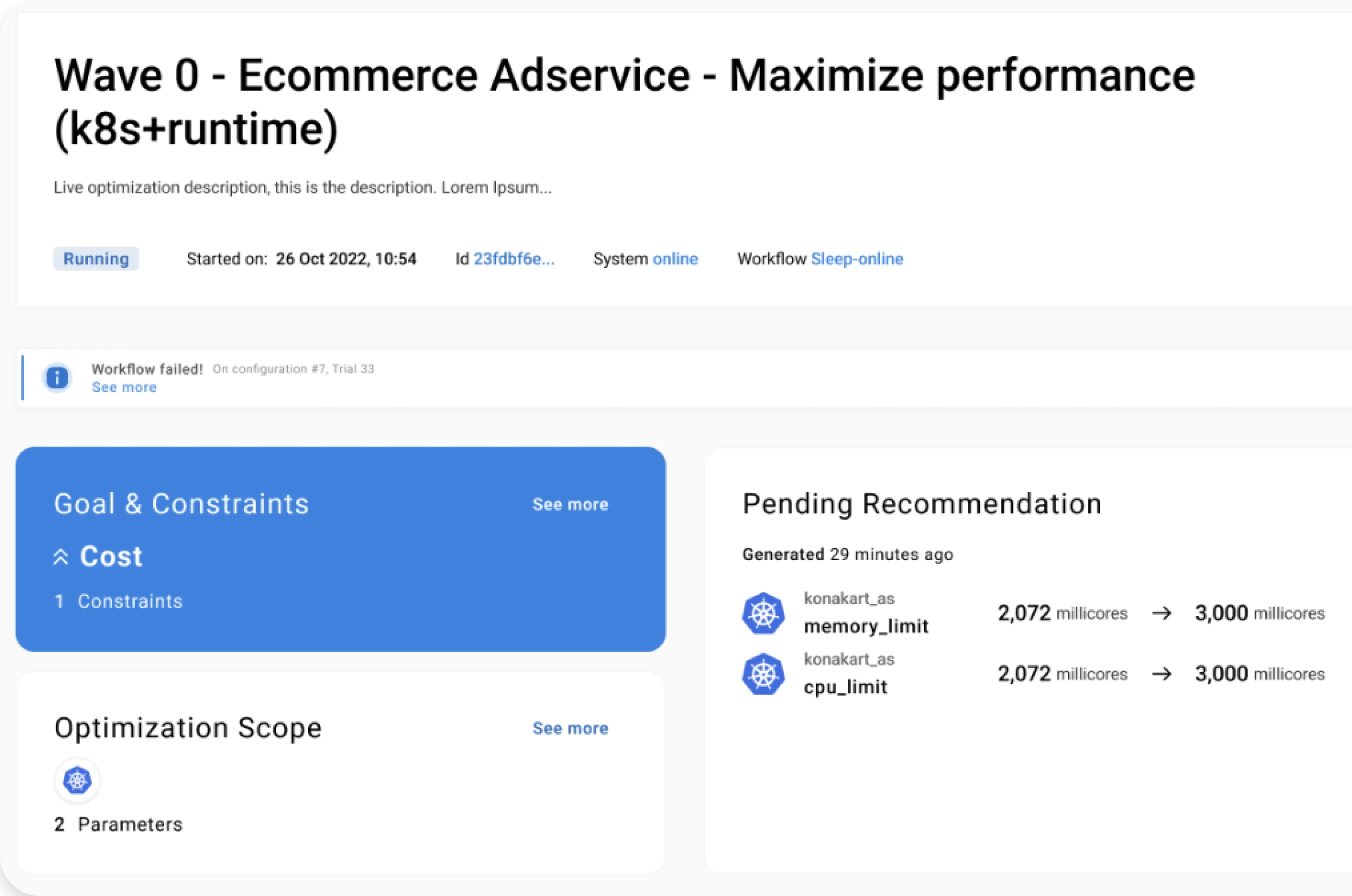

This case study describes the results achieved by a major European Digital Payment Processor in optimizing their recently-launched electronic payments service that was neither delivering the expected throughput nor matching SLAs in terms of response time.

After only twenty hours of automated tuning, Akamas identified an optimal configuration that provided the following key benefits:

- 1.5x improvement on transaction throughput;

- 20% reduction in computing resources per processed payment;

- Lowered infrastructure, license, and operational costs (undisclosed).